Calculate overtime biweekly payroll

Employees get paid every other week which. Also a bi-weekly payment frequency generates two more paychecks a year 26 compared to 24 for semi.

Elaws Flsa Overtime Calculator Advisor

Calculate the standard weekly pay.

. Work out your overtime with our Overtime Calculator. Biweekly pay has several advantages over weekly semi-monthly and monthly pay periods. The overtime calculations for bi-Weekly payroll periods arent really much different from calculating overtime on a weekly basis.

All other pay frequency inputs are assumed to be holidays and vacation. This free online bi-weekly time car calculator with two unpaid breaks and overtime will add up your or your employees. Calculate the overtime pay.

Advantages of Biweekly Pay. Get 3 Months Free Payroll. Annual Salary Bi-Weekly Gross 14 days.

Overtime pay of 15 5 hours 15 OT rate 11250. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after. Ad Payroll So Easy You Can Set It Up Run It Yourself.

See 2022s Top 10 Payroll Services. Ensure Accurate and Compliant Employee Classification for Every Payroll. Ad Learn How To Make Payroll Checks With ADP Payroll.

Biweekly pay 48 weeks. 40 x 15 600. Add up your total number of overtime hours.

Fast Easy Affordable Small Business Payroll By ADP. Hourly Payroll Calculation Worksheet This form must be opened in Acrobat Reader once downloaded in the web. This is done by taking the number of overtime hours and multiplying it by 15 in order to.

OVWK Overtime hours worked. Ad Compare This Years Top 5 Free Payroll Software. If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck.

Ad Get the Time Clock Tools your competitors are already using - Start Now. Ad Top Quality Payroll Services Ranked By Customer Satisfaction and Expert Reviews. Free Unbiased Reviews Top Picks.

Total hours in workweek. PAPR Pay period 52 for Weekly 26 for Bi-Weekly or 12 for Monthly. Unless exempt employees covered by the Act must receive overtime pay for hours.

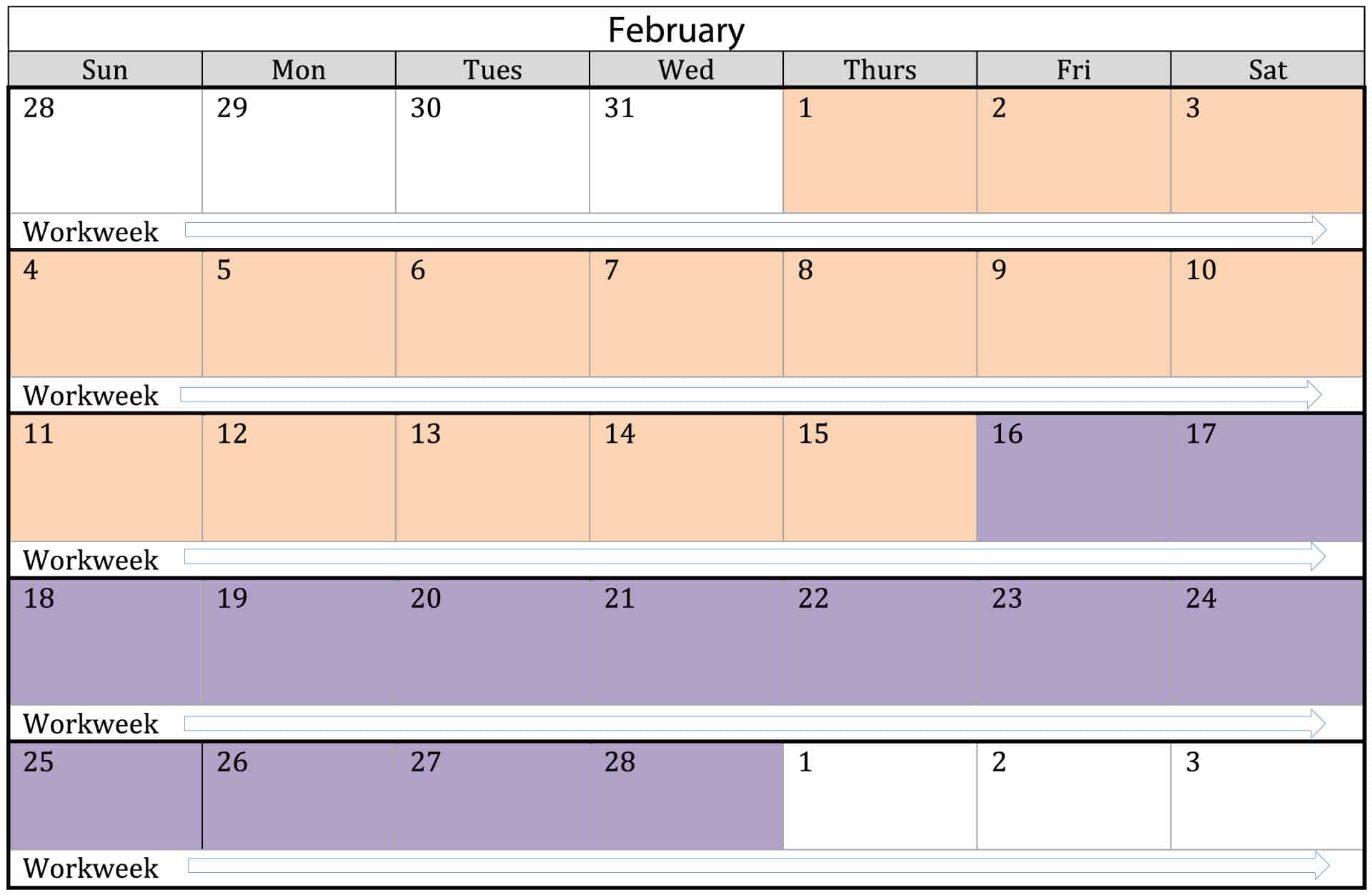

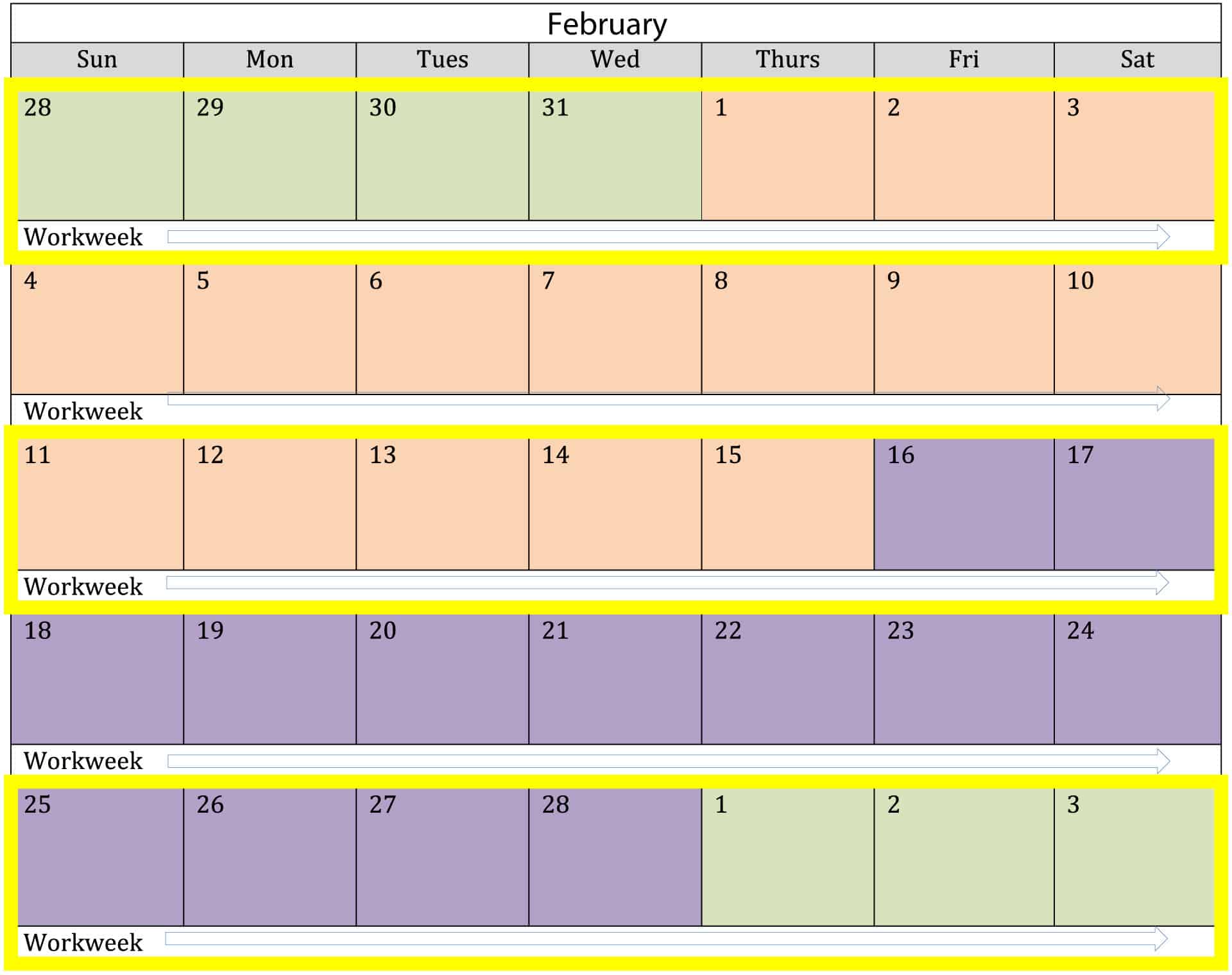

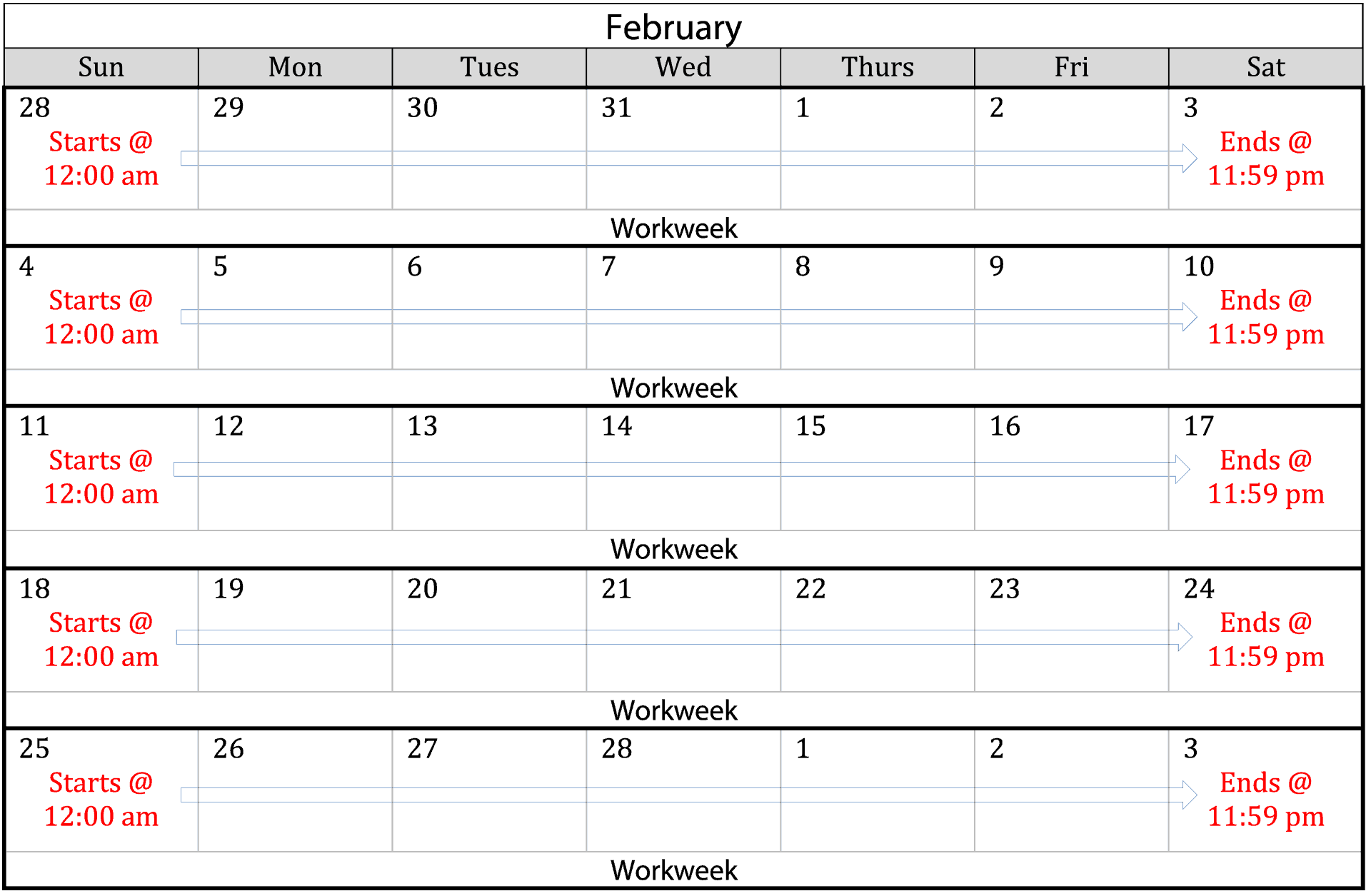

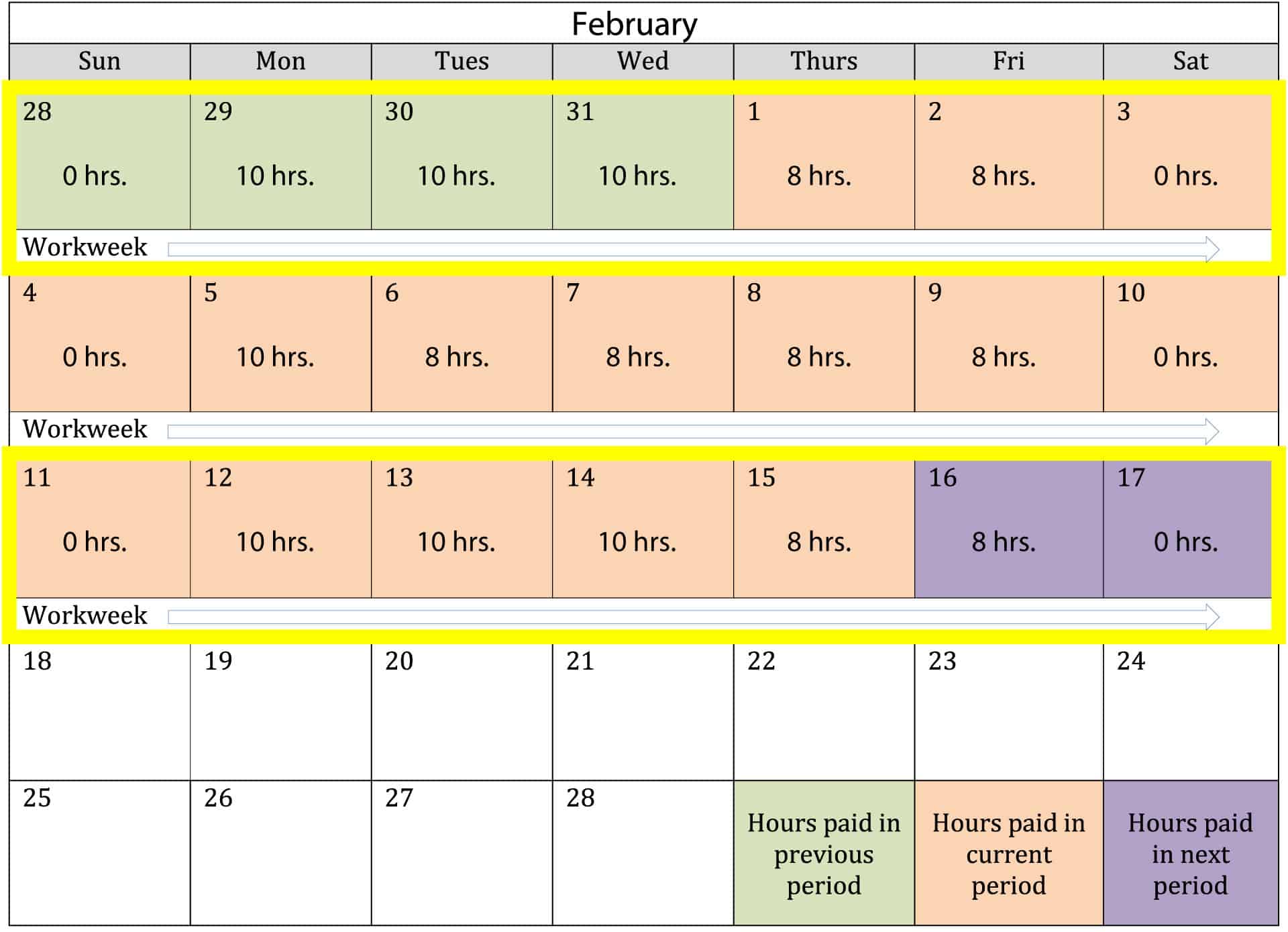

Below is an example of how an employer would calculate overtime hours in a semi-monthly pay period. 35 hours x 12 10 hours x 15 570 base pay. Overtime payments are commonly called the overtime premium or the overtime rate of payThe most usual rate for overtime hours is time and a half and that is 50 more.

Overtime is still calculated for the workweek where. Example of a result. 80 regular hours x 25 2000.

Free Online Paycheck Calculator for Calculating Net Take Home Pay. Unless specifically exempted employees covered by the Act must receive overtime pay for hours worked in excess of 40 in a workweek at a rate not less than time and one-half their regular. This calculator provided in the FLSA Excel 97-03 worksheet xls will help you compute an estimate of overtime pay for situations where multiple rates weighted average or.

This shows you the total pay you are due of regular time and overtime. This employees total pay due including the overtime premium for the workweek can be calculated as follows. The federal overtime provisions are contained in the Fair Labor Standards Act FLSA.

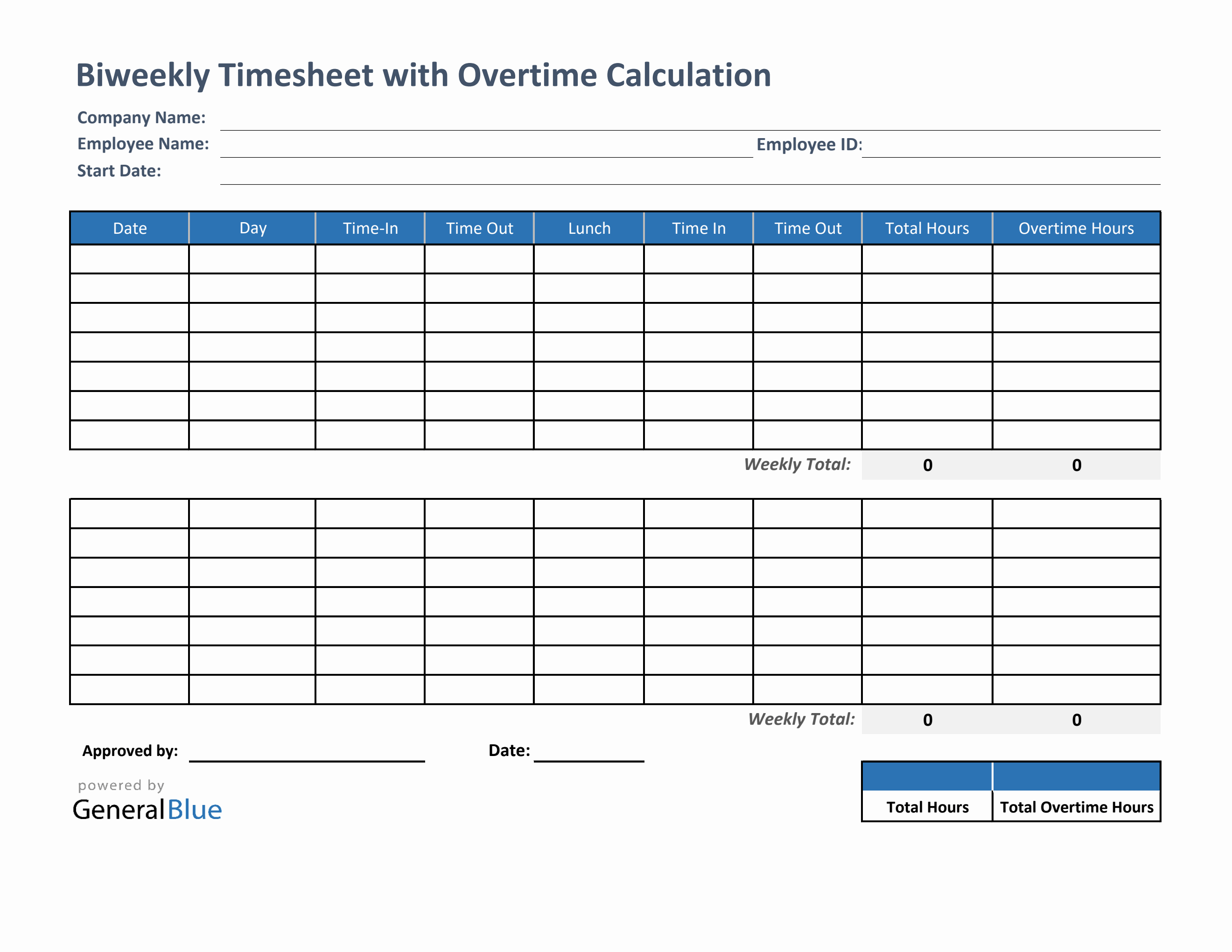

Biweekly Time Card Calculator with Up to Two Unpaid Breaks Per Day. 14 days in a bi-weekly pay period. Get 3 Months Free Payroll.

Enter your bi-weekly gross to calculate your annual salary. 570 45 total. Ad Break up with punch cards timesheets and long days of calculating everyones hours.

Number of regular hours x standard hourly rate. Fast Easy Affordable Small Business Payroll By ADP. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

365 days in the year please use 366 for leap years Formula. Using the formula overtime overtime hours regular hours x 100 follow the steps below to calculate overtime percentage. Number of overtime hours x overtime hourly rate.

Get 3 Months Free Payroll. Next you will need to calculate overtime hours. Choose Your Time Clock Tools from the Premier Resource for Businesses.

Ad Learn How To Make Payroll Checks With ADP Payroll. Holiday overtime hours will be included in the calculation of overtime. Get Instant Recommendations Trusted Reviews.

Calculating Annual Salary Using Bi-Weekly Gross. Ad Get Payroll Custom HR Policies Onboarding Terminations Performance Management More. In case someone works in a week a number of 40 regular hours.

Get 3 Months Free Payroll. Time and attendance monitoring just got a whole lot easier. All Services Backed by Tax Guarantee.

Total hours for pay.

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Exercise 7a 1 Calculate Overtime Pay Gross Pay Biweekly Earnings Youtube

![]()

Download Free Bi Weekly Timesheet Template Replicon

Free 9 Sample Biweekly Timesheet Calculators In Ms Word Excel Pdf

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Ready To Use Overtime Calculator Template With Payslip Msofficegeek

Free 9 Sample Biweekly Timesheet Calculators In Ms Word Excel Pdf

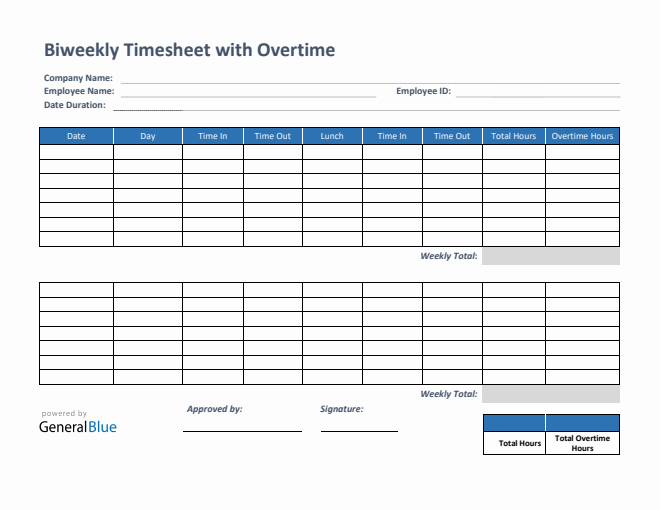

Biweekly Timesheet Templates

Logwork Free Timesheet Calculator

Annual Bi Weekly Timecard Payroll Calculator Etsy

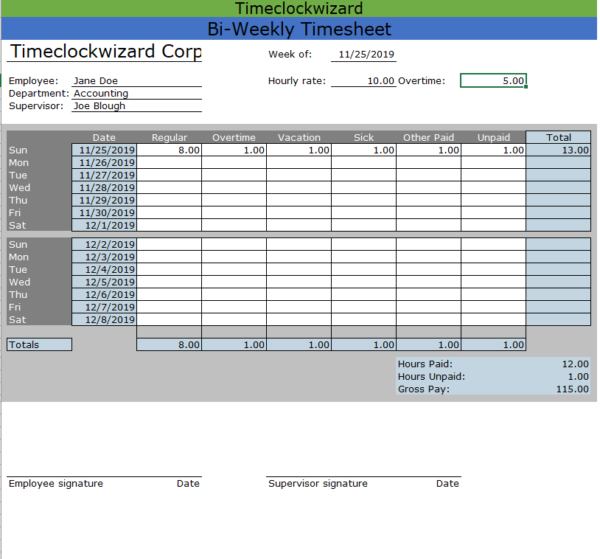

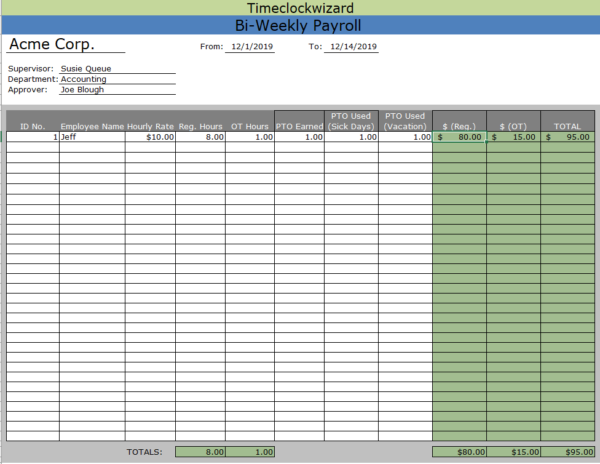

Bi Weekly Timesheet Templates Time Clock Wizard

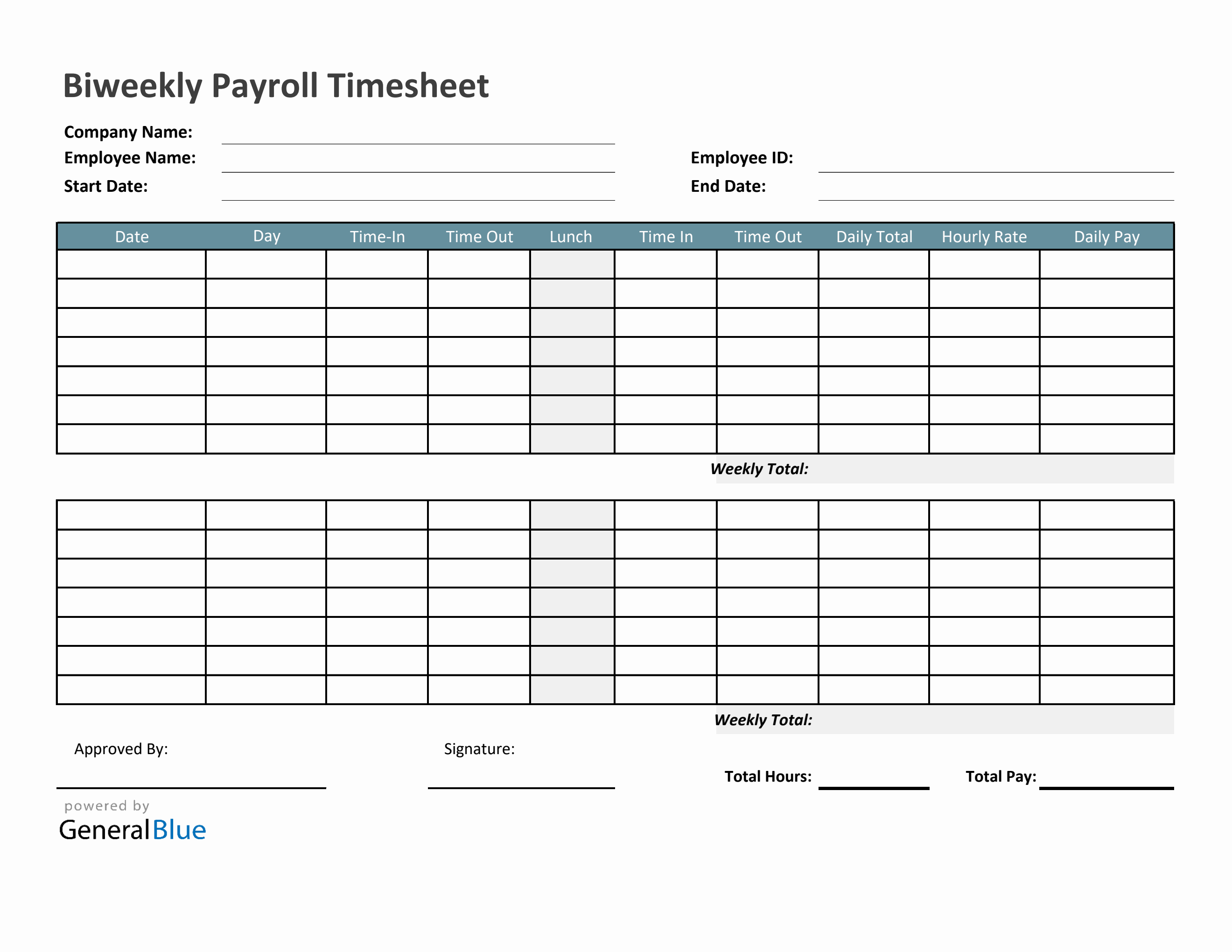

Biweekly Payroll Timesheet In Excel

Bi Weekly Timesheet Templates Time Clock Wizard

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Biweekly Timesheet With Overtime Calculation In Excel